We all want Sports.

This week the news broke that Apple is going to spend $10B over the next 10 years to acquire the rights to all MLS games from 2023. This is on the heels of their recent deal with the MLB to show “Friday Night Baseball on Apple TV+” (Peacock signed a similar deal to show 18 Sunday Baseball games).

Apple TV+ isn’t the only Streamer to spend millions of dollars to acquire rights to stream (we used to say broadcast) a popular sport, rumors are drumming up that Netflix is in negotiations with Liberty Media to acquire Formula 1 rights for upwards of $100M per year, competing with incumbent ESPN, NBC Universal and rival streamer Amazon. Amazon Prime itself made a big splash in 2021 spending a reported $1B a year to stream Thursday Night Football for the next 11 years.

Another even bigger deal went through this week, Disney lost the Streaming rights for the Indian Cricket Premier League to a Viacom/Reliance venture for $3B while retaining the Linear rights for $3B. Just five years ago Hotstar (acquired by Disney through their Fox deal) had paid the paltry sum of $2.1B for both Linear and Streaming rights, this year the IPL netted a tidy $6.2B. For context, more than a third of Disney+ subscribers, 50M, come from their Hotstar platform in South Asia, and losing the streaming rights to the IPL could see them lose up to 20M of these subscribers.

Why does all of this matter to Marketers like yourself? Advertising.

Live Sports are the last bastion of communal viewing allowing us to reach tens/hundreds of millions of consumers with the same ads. While Digital Advertising, Personalization and the dreaded Metaverse is all our industry is able to talk about, it has been proven over and over again that mass reach is what helps brands grow, and nothing does reach like Live Sports.

Why are Streamers hungry for Live Sports?

One word, CHURN.

Yes, the Streaming category has been steadily growing over the past two years, fueled in part by the Pandemic and everyone being home:

Surprise to some, but not to those able to look back further than two years, a combination of the Pandemic easing up and Inflation ruining the party like a drunk uncle at Christmas, churn is now the most important metric for Streamers. Here’s a TL;DR sad history of the last two years:

Netflix ruled Streaming virtually unopposed for years

All the major Entertainment giants decided it was time to stop subsidizing Netflix and launch their own Streaming platforms

The Pandemic hit, we were all forced to stay home and decided to subscribe to every single streaming service in the world (an average of 9 per household at peak Pandemic)

In 2022 the Pandemic slowed down, we decided to pretend it was over, inflation hit and we all realized we were spending more money on Streaming than on food so we started unsubscribing from services we didn’t really use

Wall Street hates churn and decimated Netflix’s stock price when they announced a negative Subscriber growth for the first time ever

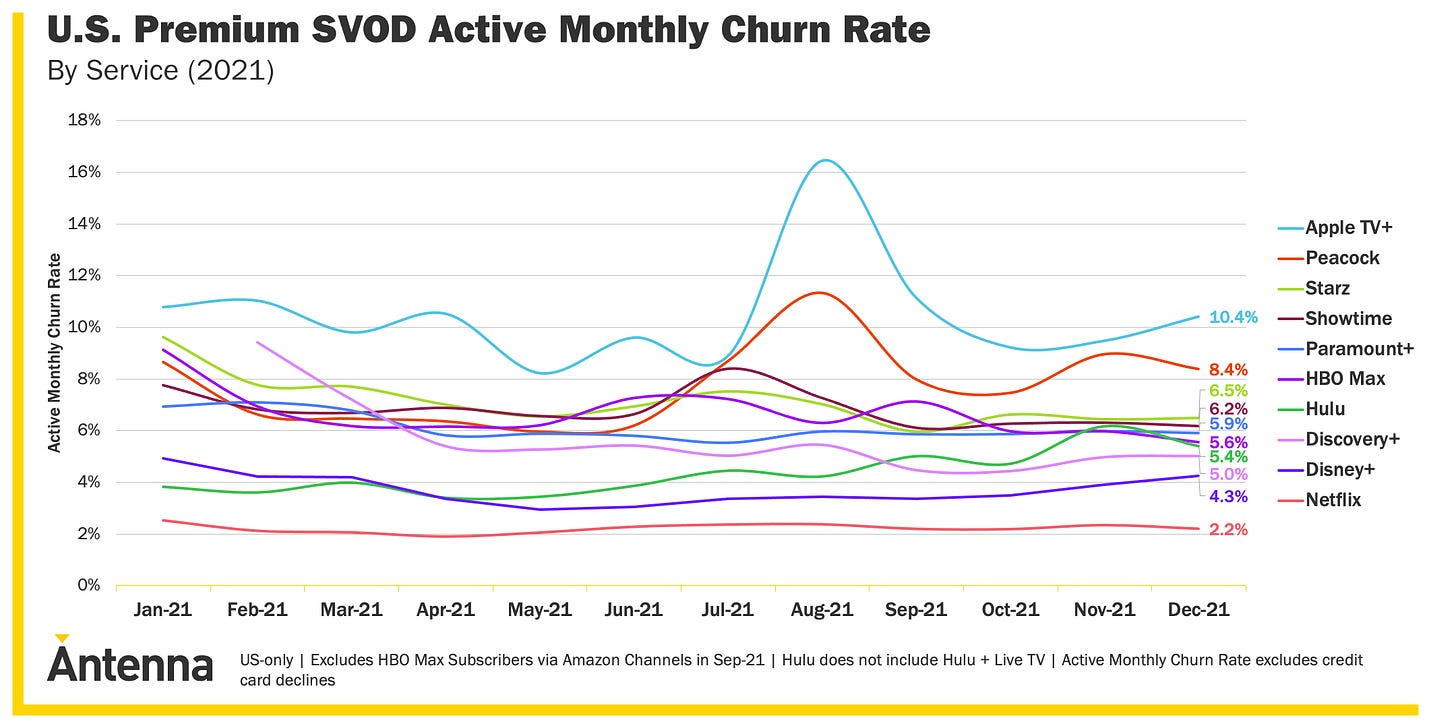

Apple TV+ has had the worst churn in the category since its launch, easily explained by the fact that it had no library (new content tends to drive new subs, library tends to keep people subscribed), and that Apple was basically giving it away for free for a year and then started charging:

You can also see that churn has started becoming a bigger problem for all Streamers and will only get worse as people’s spending ability decreases and they have to prioritize where their money goes:

These charts are from Antenna, one of the if not the best sources of insights on the Streaming industry, which is notoriously difficult to measure. I’ll include a list of resources at the bottom if you want to learn more.

The answer to the existential threat that is churn? Live Sports. The only thing really keeping cable alive, together with Live News (or rather the hyper politicized thing that is destroying the fabric of this country, but that’s for another time).

Apple TV+ is only the latest Streamer to jump on the sports bandwagon, which is becoming an increasingly complicated matrix of rights split between broadcasters and streamers.

Why Soccer?

I have a theory about why Apple picked MLS, and it’s not Ted Lasso, it’s Demographics.

Soccer is the fifth most popular sport in the US, but it’s no step child, not where it matters, it’s audience. Specifically, their demographics:

iPhone is the dominating Smartphone for a wealthier and whiter consumer, MLS is incredibly popular with Hispanic consumers, a group Apple has historically struggled with compared to Android. It’s also a younger audience (which tends to be more diverse), helping Apple consolidate its dominance of the Smartphone market early on:

The smart thing is that Apple is going to most likely offer some games up for free as long as you have an Apple ID. What better way to grow your penetration than by giving consumers something they want for free and slowly nudging them towards the promise of a more blessed life inside the golden cage of iOS?

This is likely a test for Apple to see if it’s worth bidding for bigger sports in the future. $10B is a lot of money for most brands, but for Apple who holds over $200B in cash it’s a drop in the bucket, one that could very well lead to acquiring a lot of new iPhone users and critical learnings on how to become an Entertainment giant.

Why I’m Skeptical.

"If we want things to stay as they are, things will have to change."

These immortal words are from the 1958 novel “The Leopard”, “Il Gattopardo”, written by Italian novelist and last Prince of Lampedusa, Giuseppe Tomasi di Lampedusa. In it he describes the tumultuous changes happening in Italy in the 19th century.

Everything must change so that everything stays the same perfectly describes our society and the changes we’re seeing happen in Streaming (and frankly most other industries).

We’ve long believed that more choice was good for consumers, but we’re seeing increasingly this is far from true. Cable is stupidly expensive and you only really watch a few channels out of the hundreds you get access to, so enter the freedom of streaming. A promised land where you only pay for the content you really want. Until you have to pay for 8 streaming services for a total of more than $100 a month to stitch together your own version of cable that is a lot clunkier to navigate. I still need to google “where can I watch [insert game/match]?” on a regular basis, it’s incredibly frustrating, and expensive. At least Serie A (which is my favorite sport to watch being a huge AS Roma fan) is all on Paramount+, good luck figuring out how to watch your favorite Football, Baseball or Basketball team, where games are spread out between different broadcasters and streamers.

This isn’t great news for advertisers, as most streaming services don’t have ads, yet. Netflix is preparing to launch a cheaper ad-supported service, following in the footsteps of HBO Max, Hulu and Peacock, to name a few. There really isn’t a better place to make money from ads than broadcasting live sports, which is what I think is driving, in part, Netflix’s decision to bid for Formula 1. Sure, it will perfectly complement their monster hit “Drive to Survive”, forcing all F1 fans to get Netflix, if they don’t have it already, but I think that it also makes their push to an ad supported tier a lot more attractive.

Why I’m Optimistic.

This is the right move for any Streamer wanting to still be around in the next two years. Spending billions on original content is not a sustainable growth strategy, as Netflix’s recent woes are showing. Original content will continue to be what draws people to your service, Live Sports and a deep Library will keep them subscribed.

The Circle of Life is nearing its final stage for Streaming, maturity. The arms race fueled by Original Content is entering a new phase where Streamers consolidate. The next step will be smaller services being gobbled up by the big ones into Bundles that will eerily resemble Cable, until it all goes back to one or two big providers. I suspect the ones left standing will be Netflix (if it figures out Live content), HBO/Discovery, Apple TV+ and Amazon Prime (regardless of whether they become profitable business units since they’re owned by two of the richest companies in World history). With more and more ad-supported tiers, the shifting of Live Sports to Streaming may not be as big of a hit to advertisers as I fear at this moment. One thing is for sure, Live Sports are going to get bigger and bigger, which will always offer brands exciting ways to reach consumers.

Let the games continue.

List of useful resources on Streaming: